‘Losses loom greater than gains’. Such a clear statement is the conclusion at which Kahneman and Tversky arrived after studying people's preferences when dealing with situations that involve uncertainties.

To find out what it means in the real world, take a look at the bets below:

A little test

We are going to toss a coin. If it is tails, you win 50, if it’s heads, you loose 50.

Would you play?

Because we are more sensitive to losses than to equivalent gains, we need to gain a lot more in order to accept the risk to lose. In fact, this bias has been quantified: gains need to be about 2 times bigger than losses in order to compensate for our loss aversion. Which bets did you accept?

Hating to lose comes in several flavors.

Let’s start by talking about the status quo bias: changes to our present situation are seen as potential loses to what we already have. So, just in case we keep things as they are.

Another face of loss aversion is the power of scarcity. The prospect of not being able to buy an item because of shortage is a strong motivation to get it. Online retailers show how many are items left as one way to create the feeling of scarcity. Creating a real shortage is another strategy: the diamond market works this way.

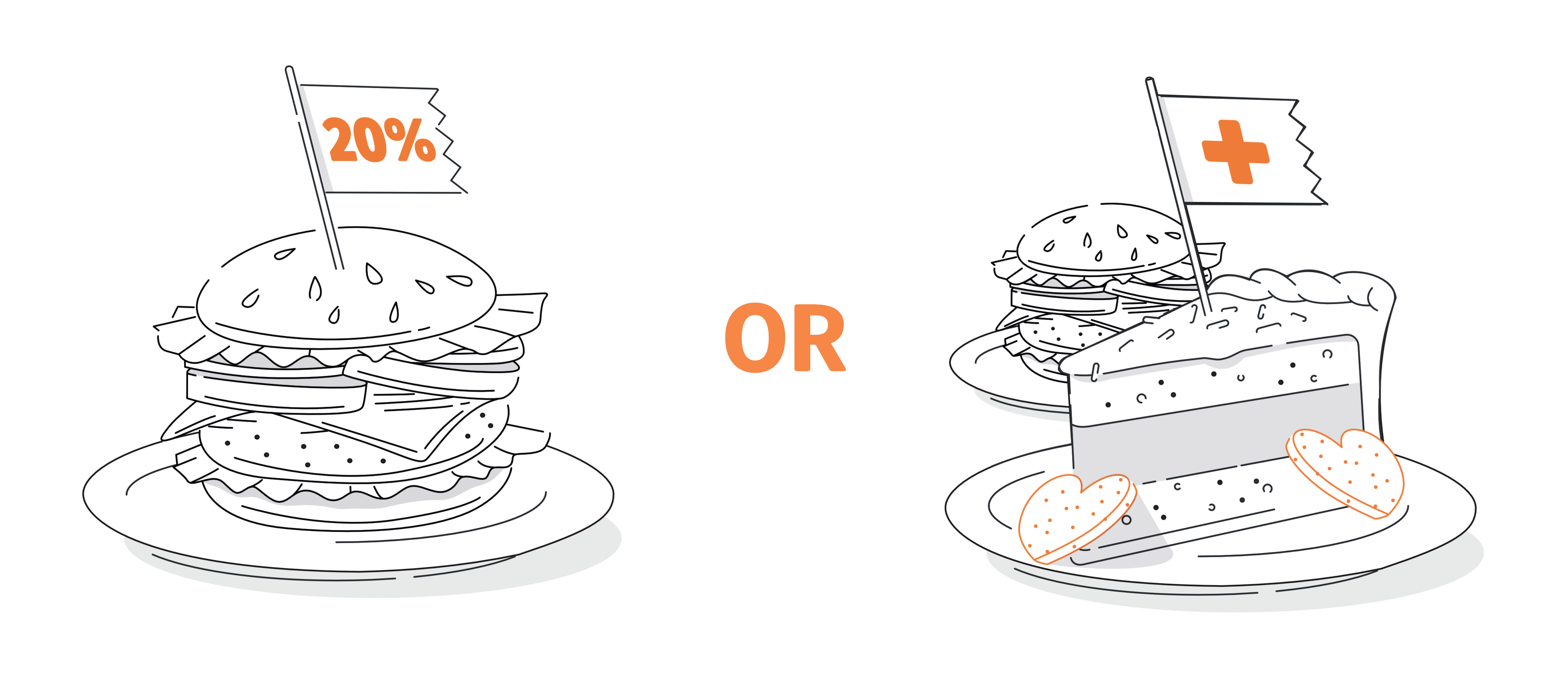

What about free gifts? Suppose your are going to your favorite restaurant and you can choose between the dish you want that comes 20% bigger, or the regular size dish plus a free dessert.

A little test

Which one would you prefer?

After all, we hate to lose!